Industry:

FinanceTechnologies:

WordpressProject

Introduction

Kanata Lending, Canada’s premier online mortgage company, embarked on a digital transformation journey to redefine the mortgage lending experience. The project aimed to leverage cutting-edge technology to provide a convenient, efficient, and user-friendly lending solution. This case study delves into the strategic approach, challenges, and innovative solutions employed in transforming Kanata Lending’s digital presence.

The scope of this project was to create a digital ecosystem that not only simplifies the mortgage process but also offers a competitive advantage in the financial services sector. The initiative was designed to enhance customer experience, drive revenue through digital channels, ensure cost-effectiveness, and maintain high standards of data security and user interface design.

Objective

The primary objectives for Kanata Lending’s digital transformation were:

-

01/

Utilizing a Robust Data Platform

To implement a data platform that provides speed, agility, and a competitive edge, essential for financial services.

-

02/

Development of Financial Calculators

To host advanced financial calculators on the website, enabling clients to make informed decisions regarding their finances.

-

03/

Integration of a Custom-Built Chatbot

To equip the website with a chatbot powered by MongoDB for quick responses and a smooth user experience.

-

04/

Enhancing User Decision-Making Tools

To provide tools like advanced mortgage calculators and plan comparison features, aiding users in finding the right plans with the best interest rates.

Project Challenges

Data Platform Selection and Integration

Choosing the right data platform that aligns with the speed and agility needs of the financial services sector.

User-Friendly Financial Tools Development

Creating user-friendly yet advanced financial calculators and decision-making tools that cater to diverse user needs.

Custom Chatbot Development for Enhanced Engagement

Developing a custom chatbot that not only responds quickly but also accurately understands and addresses user queries related to mortgages.

Ensuring Smooth User Experience and Navigation

Designing a website that balances comprehensive functionality with ease of navigation, ensuring a frictionless user journey.

Scalability and Security

Ensuring the platform is scalable to handle growing user traffic while maintaining stringent data security standards, crucial in the financial services industry.

Solutions

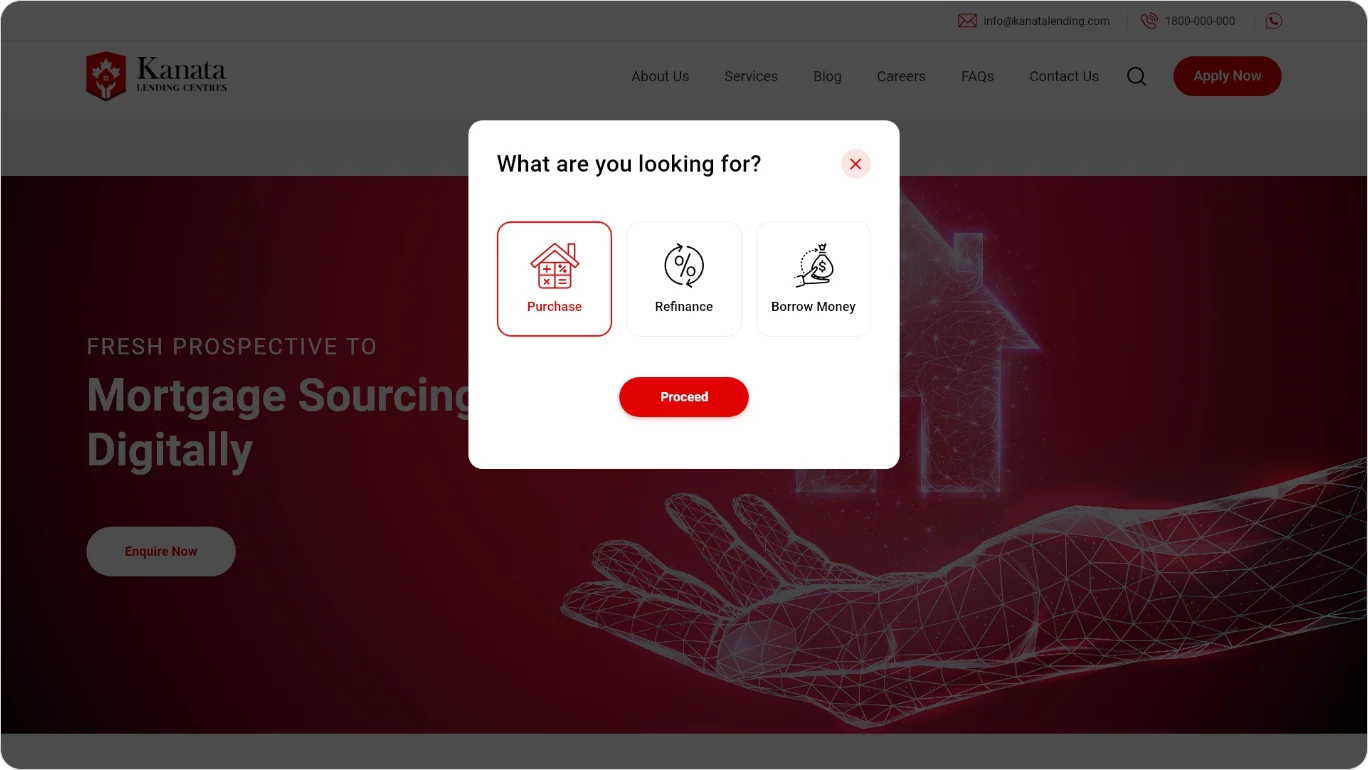

Development of Kanata Lending's Online Mortgage Platform

Robust Data Platform Integration

The foundation of Kanata Lending's digital transformation was the integration of a robust data platform. This platform was selected for its speed and agility, crucial for the dynamic financial services sector. It provides a competitive edge by enabling real-time data processing and decision-making.

Advanced Financial Calculators

The website hosts sophisticated financial calculators, allowing clients to make informed decisions regarding their mortgage and finances. These calculators were designed to be user-friendly yet provide comprehensive financial insights, aiding clients in understanding various mortgage scenarios.

Custom-Built Chatbot with MongoDB

A key feature of the website is a custom-built chatbot, powered by MongoDB. This chatbot is designed for quick responses and a smooth user experience. It utilizes advanced algorithms and database management to provide accurate and timely information to visitors.

User Flow and Architecture

The user flow and site architecture were meticulously planned to ensure a seamless and intuitive user experience. The website was structured to guide users effortlessly through the mortgage process, from initial inquiry to final decision-making.

Technology Stack

The proposed technology stack for Kanata Lending's platform was chosen for its scalability, security, and performance. Key technologies included:

- A flexible content management system for easy management of website content.

- Integration of essential third-party tools like payment gateways.

- Secure and PCI-compliant integrations for online transactions.

Magento Community Edition Advantages

Magento Community Edition was selected for its ability to manage a multi-brand e-commerce website efficiently. It offers:

- Fast loading times for an enhanced user experience.

- Flexible content management.

- Easy product management features.

- Secure e-commerce store builds, crucial for building user trust in online transactions.

- A vast community for support and sharing of best practices.

Results

& Impact

The launch of Kanata Lending's online mortgage platform has led to significant achievements in enhancing user engagement, operational efficiency, and overall business performance. The following key performance indicators underscore its impact:

User Engagement

The platform has experienced a 40% month-over-month increase in user interactions, indicating growing trust and acceptance among consumers. This surge is a testament to the platform's appeal and effectiveness in connecting with users.

Operational Efficiency

The integration of a robust data platform and the streamlined backend processes have led to a 30% reduction in operational costs. This efficiency is attributed to the automation of various mortgage processing operations and inventory management.

Conversion Rate

Since the platform went live, there has been a noticeable increase in conversion rates, with users actively engaging and completing mortgage applications.

Chatbot Efficiency

The custom-built chatbot powered by MongoDB has significantly improved user interaction, leading to quicker response times and higher satisfaction rates in plan selection and queries.

Advanced Analytics Utilization

The implementation of comprehensive e-commerce analytics tools like GTM and MixPanel has provided in-depth insights into user behavior, mortgage trends, and marketing effectiveness.

User Satisfaction

The platform has received overwhelmingly positive feedback, with a high Net Promoter Score (NPS). Users have particularly praised the ease of navigation, the innovative chatbot feature, and the comprehensive mortgage calculators provided by the platform.

Business Impact

From a business perspective, the platform has significantly enhanced Kanata Lending's online presence, opening up new revenue streams and contributing to the brand's growth in the digital mortgage marketplace. The unified approach to mortgage processing has not only attracted new customers but also improved the mortgage application experience, leading to increased applications and customer retention.

Technological Benchmark

The Kanata Lending platform has set a new technological benchmark in the online mortgage industry. It serves as a case study in how advanced technologies like robust data platforms, real-time analytics, and secure e-commerce architectures can be seamlessly integrated to enhance the customer experience and solve complex business challenges.

Project

Summary

The digital transformation of Kanata Lending has had a transformative impact on the brand's online mortgage strategy. By addressing the challenges of multi-brand integration, user engagement, operational efficiency, and technological innovation, the platform has not only met its objectives but has exceeded them in many respects. The platform stands as a testament to the power of digital transformation, setting new standards in user experience, business efficiency, and technological innovation. It serves as a blueprint for how technology can be leveraged to create value, solve complex challenges, and make a meaningful impact in the online mortgage sector.

More

Case Studies

Next Level Tech,

Engineered at the Speed of Now!

Are you in?

Let Neuronimbus chart your course to a higher growth trajectory. Drop us a line, we'll get the conversation started.