Types of Mobile Payment Apps

The mobile payment landscape is broad and continually evolving, shaped by consumer demand for convenience, security, and speed. At the core of this transformation are various types of mobile payment apps, each serving specific market needs and user behaviors. Businesses aiming to integrate or build mobile payment solutions must understand these models and their practical applications.

Closed-Loop Mobile Payment Systems

- Definition and Business Model

Closed-loop mobile payment systems are proprietary platforms developed by individual businesses for transactions solely within their ecosystem. These apps are typically connected directly to the merchant’s POS systems, bypassing traditional banking and card networks. This structure gives businesses full control over every transaction and the customer journey. - Integration with Loyalty Programs

A defining characteristic of closed-loop systems is their tight integration with loyalty and rewards programs. Starbucks, one of the pioneers of this model, allows users to preload funds, earn stars with purchases, redeem offers, and access promotions—all within one seamless interface. This fosters repeat usage and encourages higher customer retention. - Cost Efficiency and Data Ownership

Since these apps cut out intermediaries, businesses save on third-party transaction fees and gain access to rich consumer data. This allows for detailed behavioral analytics, enabling brands to tailor marketing campaigns and improve customer experience. However, these advantages come at the cost of high development and operational investments. - Adoption Challenges

Despite the benefits, closed-loop systems can struggle with user adoption, especially if the brand doesn’t have daily interaction with its audience. Customers are unlikely to download and engage with a standalone app unless it delivers consistent value, speed, and utility beyond payments.

Open-Loop Wallets

- Universal Accessibility

Open-loop wallets such as Apple Pay, Google Pay, and Samsung Pay are digital wallets that work across a wide network of merchants. They allow users to store multiple forms of payment, including debit and credit cards, loyalty memberships, and even public transit passes. These apps are often pre-installed on smartphones, increasing their adoption and usability. - Technology at the Core

These systems use NFC (Near Field Communication) or QR codes for contactless transactions. NFC enables seamless tap-and-pay functionality, making in-store purchases quick and secure. Some platforms also offer tokenization, replacing card details with encrypted digital tokens, enhancing safety during transactions. - Enhanced User Experience

The hallmark of open-loop wallets is their convenience. A user can check out online or in-store in seconds without fumbling for cash or cards. They also support biometric authentication, like fingerprint scanning or facial recognition, streamlining both security and speed. - Operational Considerations for Businesses

To accept open-loop wallets, businesses must invest in compatible POS systems and payment gateways. This can be a barrier for small retailers or service providers. Furthermore, since third-party providers control the platform, businesses have limited access to transaction data and customer touchpoints.

Peer-to-Peer (P2P) Payment Platforms

- Consumer-Centric Use Cases

Peer-to-peer (P2P) payment apps are designed to enable fast, direct transfers between individuals. Apps like Venmo, Cash App, and Zelle have gained traction for their simplicity and speed. Use cases range from splitting dinner bills to paying rent or reimbursing friends. - Social and Financial Integration

Some P2P platforms feature social feeds, emojis, and transaction comments, appealing particularly to younger demographics. This social layer turns mundane transactions into interactive experiences, encouraging frequent usage and organic promotion through peer networks. - Small Business Utility

Beyond social use, freelancers, sole proprietors, and micro-entrepreneurs often rely on P2P platforms to accept payments. These apps offer fast settlement, minimal setup, and a user-friendly interface. However, they lack advanced business tools such as invoice generation, multi-user access, or tax documentation. - Security and Regulation

As these platforms handle increasing transaction volumes, they face heightened scrutiny over fraud prevention and compliance. Financial regulators are closely monitoring P2P platforms to ensure they meet anti-money laundering (AML) and data privacy standards.

Let’s build your mobile payment future—together.

Need help designing your payment solution?

Contact Neuronimbus today.

Hybrid Payment Platforms and Super Apps

- All-in-One Ecosystems

Hybrid payment platforms, often referred to as “super apps,” combine multiple payment functions within a single application. Apps like WeChat Pay and Alipay are the benchmarks of this model, enabling users to make payments, send money, shop online, book services, and invest—all without leaving the app. - Market Penetration and Engagement

These apps have dominated in Asia, where mobile-first infrastructure and user expectations are higher. Their design supports deeper user engagement by offering utility across numerous daily tasks. Businesses benefit from embedded commerce, while users enjoy end-to-end convenience. - Expansion in the West

In Western markets, apps like PayPal and Cash App are evolving into super apps by adding features like stock trading, cryptocurrency management, and e-commerce integration. This convergence is reshaping what users expect from payment apps and is pushing traditional financial institutions to rethink their digital strategies. - Opportunities and Risks

While super apps promise unparalleled convenience and user retention, they also raise concerns about data centralization, over-reliance on a single ecosystem, and vendor lock-in for businesses.

Choosing the Right Mobile Payment Strategy

- Aligning with Business Goals

The best mobile payment solution depends on a business’s size, customer base, technical infrastructure, and growth strategy. A retail brand with high-frequency purchases may benefit from a closed-loop app that deepens loyalty. A small merchant with a broad audience might prefer open-loop integration for ease of use. - Scalability and Future-Proofing

Businesses should consider not just current needs but also scalability. As digital wallets expand and new standards emerge—like biometric authentication, digital identity verification, and blockchain-based payments—flexibility and future readiness are crucial. - User-Centric Design

Regardless of app type, user experience must remain central. Smooth onboarding, real-time support, intuitive interfaces, and secure workflows are non-negotiables in a competitive payment landscape.

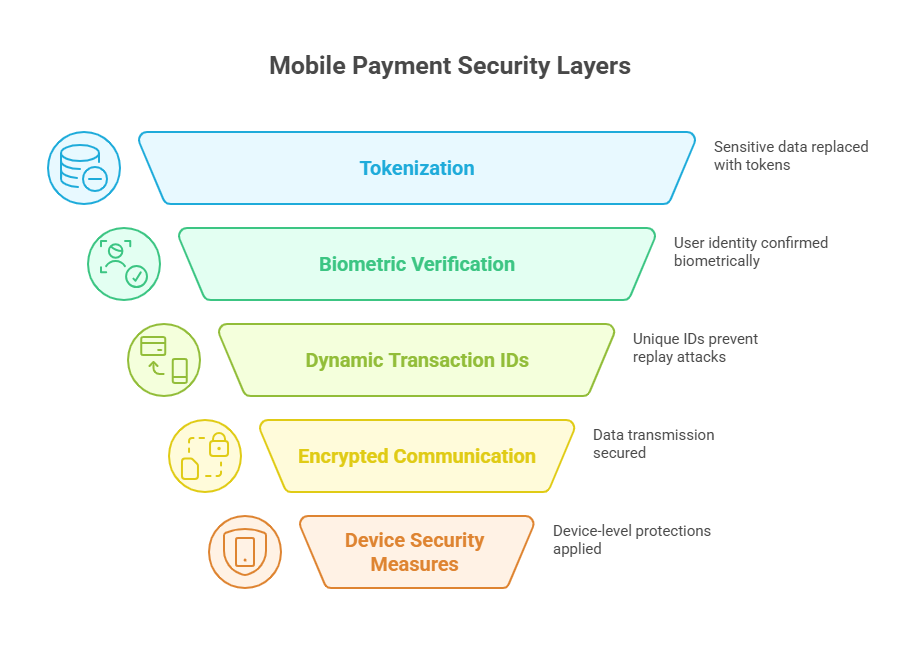

Security Architecture of Mobile Payment Apps

Mobile payment systems are built on a foundation of advanced security protocols that go beyond traditional card-based transactions. With increasing concerns about data breaches and cyber threats, modern payment apps are designed with multi-layered defenses to safeguard user data, ensure transaction integrity, and minimize fraud risk.

Tokenization for Sensitive Data

Tokenization is a process where actual card information is replaced with a randomly generated string or “token.” This token holds no exploitable value outside of the app or transaction session. Even if intercepted, the token reveals nothing about the user’s actual financial details. It significantly reduces the chances of sensitive data being stored or transmitted insecurely, providing a vital layer of abstraction between the customer and the threat landscape.

Biometric Verification for User Authentication

Biometric authentication adds a robust layer of user verification. Using fingerprints, facial recognition, or iris scans, biometric systems ensure that only the rightful device owner can authorize transactions. These biological identifiers are nearly impossible to replicate, making them a powerful defense against unauthorized access. By combining biometrics with passwords or PINs, mobile payment apps employ a dual-factor authentication model that strengthens overall security.

Dynamic Transaction IDs for Payment Validation

Each mobile transaction is assigned a unique, one-time-use ID, known as a dynamic transaction ID. These identifiers expire after a single session, preventing attackers from replaying intercepted transaction data. This system ensures that even if a malicious actor captures a transaction in transit, the data becomes useless, drastically minimizing the possibility of duplicate charges or fraudulent activity.

Encrypted Communication Channels

Mobile payment apps utilize end-to-end encryption to secure all data transmission. Whether it’s during authentication, transaction processing, or backend verification, information is scrambled using advanced cryptographic protocols. This prevents eavesdropping and man-in-the-middle attacks, ensuring that sensitive data remains protected from interception and tampering.

Device and App-Level Security Measures

In addition to network-level protections, mobile payment apps incorporate device-level safeguards such as screen locks, OS-level sandboxing, and app-specific PINs. Many platforms also prevent screenshots or restrict use on rooted/jailbroken devices. These built-in defenses ensure that even if a device is compromised, unauthorized use of the payment app remains difficult.

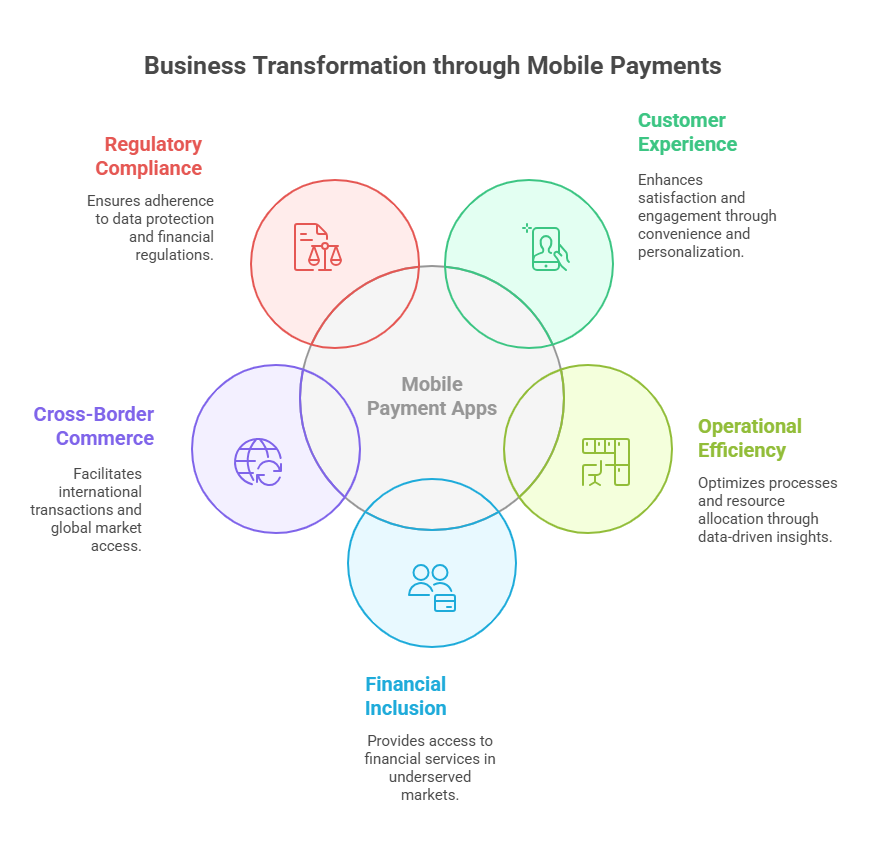

Business Impact of Mobile Payment Apps

The rise of mobile payment apps is not just a technological shift—it’s a business transformation. From customer experience to operational workflows and global reach, mobile payments are reshaping how companies interact with customers and manage transactions.

Customer Behavior and Experience Enhancement

Mobile payment apps accelerate the checkout process, reducing friction and improving user satisfaction. This convenience often translates into increased conversion rates—especially on mobile-first platforms. Furthermore, integration with loyalty programs allows businesses to deliver personalized offers, push notifications, and instant rewards, keeping users engaged. Consumers also benefit from real-time financial tracking, helping them manage budgets and reinforcing app usage through perceived value.

Operational Efficiency and Internal Optimization

Mobile payments enable businesses to gather rich transaction-level data, providing insights into customer preferences, peak purchase times, and payment behavior. This data fuels predictive analytics, helping optimize inventory and forecast demand. Moreover, automation of previously manual processes—such as reconciliation, invoice tracking, and fraud alerts—frees up operational resources, allowing teams to focus on strategic growth rather than routine admin tasks.

Promoting Financial Inclusion in Underserved Markets

In regions where traditional banking is limited or expensive, mobile payment apps offer an accessible financial lifeline. They allow unbanked or underbanked users to send, receive, and store money securely without requiring a physical bank account. This democratization of finance opens new markets for businesses and empowers individuals to participate in the digital economy with minimal barriers to entry.

Enabling Cross-Border Commerce

Mobile payment apps reduce the friction involved in international transactions. By abstracting away complex currency conversions, SWIFT fees, and long settlement cycles, these platforms enable smoother global commerce. Businesses can serve international customers with less overhead, while consumers enjoy simplified purchases without worrying about exchange rates or fees.

Navigating Regulation and Compliance

As mobile payments proliferate, they are increasingly scrutinized by regulators. Businesses must ensure compliance with data protection laws like GDPR in Europe, PCI-DSS for card data, and local Know Your Customer (KYC) regulations. Apps must include features that ensure secure consent handling, encryption, and auditability. Failure to comply risks not only fines but reputational damage and customer trust erosion.

How Can Neuronimbus Help You?

Neuronimbus is a trusted partner for businesses looking to innovate in the mobile payments space. With expertise in building secure, scalable, and user-centric applications, Neuronimbus helps brands develop custom mobile payment solutions—from closed-loop wallets to full-scale open-loop integrations. Our team ensures compliance with global standards like PCI-DSS and GDPR while embedding advanced security features such as tokenization and biometric authentication. We combine intuitive UI/UX, robust backend systems, and AI-driven personalization to deliver seamless payment experiences. From strategy and development to ongoing support, Neuronimbus provides end-to-end capabilities that help future-proof your digital payments and drive long-term business growth. The world is moving towards mobile-first transactions. With the right strategy and execution, your app can become more than a payment gateway—it can be a core business channel. Neuronimbus is ready to help you build, scale, and secure it for tomorrow’s digital economy.